Why Small Interest Rate Increases are Kind of a Big Deal!

Waiting to purchase or refinance a home could cost you tens of thousands in buying power.

Mortgage rates are on the rise and with inflation at highs not seen since 1982, experts predict more rate increases this year. The good news is that while mortgage rates have risen to early 2020 levels, they remain historically low.

But when combined with soaring home prices, it’s important to understand how interest rate increases–no matter how small– impact your buying power.

Your “buying power,” how much home you can afford, is directly correlated to the mortgage interest rate you can secure. As rates climb, your buying power decreases significantly. In fact, rising rates can hurt buying power even more than increasing home prices. So how does your purchasing power change if rates creep up a half a point or even one full percentage point?

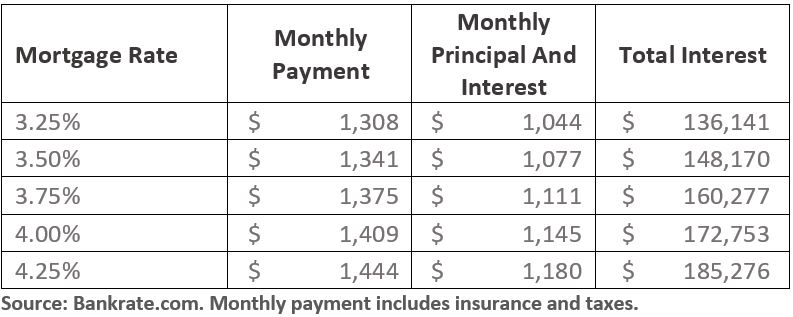

Imagine you wish to take out a 30-year fixed loan on a $300,000 home with a 20% down payment. A 1% difference in your interest rate can make a big difference over time:

While it might not seem like much, a single percentage point increase can potentially cost you tens of thousands of dollars on a 15- or 30-year mortgage—in this example to over $49,000! That home you were planning to buy at 3.25% may no longer be affordable at 4.25%.

So if you’re in the market for a new home, it pays to shop now and lock in a favorable rate. Likewise, if you’re planning to refinance, lower rates can put interest savings back into your bank account for you to enjoy both now and in the future.

Even if you missed out on historically low mortgage rates in 2021, the current mortgage rate environment is still favorable for potential homebuyers and those thinking about refinancing. But the longer you wait, the greater you risk reducing your buying power.

If you decide it’s time to make a move, our Real Estate Benefits Program can connect you with a local Realtor–and it provides a cash rebate!

Our program also provides access to mortgage financing with an alumni rate discount, which could also save you thousands.